CASH Simulation, Part 6: Simulated vs Read data

Lei Sun

2017-11-19

Last updated: 2017-11-22

Code version: 1a77d56

Observation

After extensive exploratory simulations, it seems completely simulated data give cleaner results than simulated real data, which is expected.

source("../code/gdash_lik.R")set.seed(777)

z.mat <- se.mat <- matrix(0, ncol = 1e4, nrow = 1e3)

for (i in 1 : nrow(z.mat)) {

L <- matrix(rnorm(1e4 * 10), ncol = 10)

z.mat[i, ] <- L %*% rnorm(10) / sqrt(rowSums(L^2))

se.mat[i, ] <- sqrt(rchisq(1e4, 1))

}Simulation

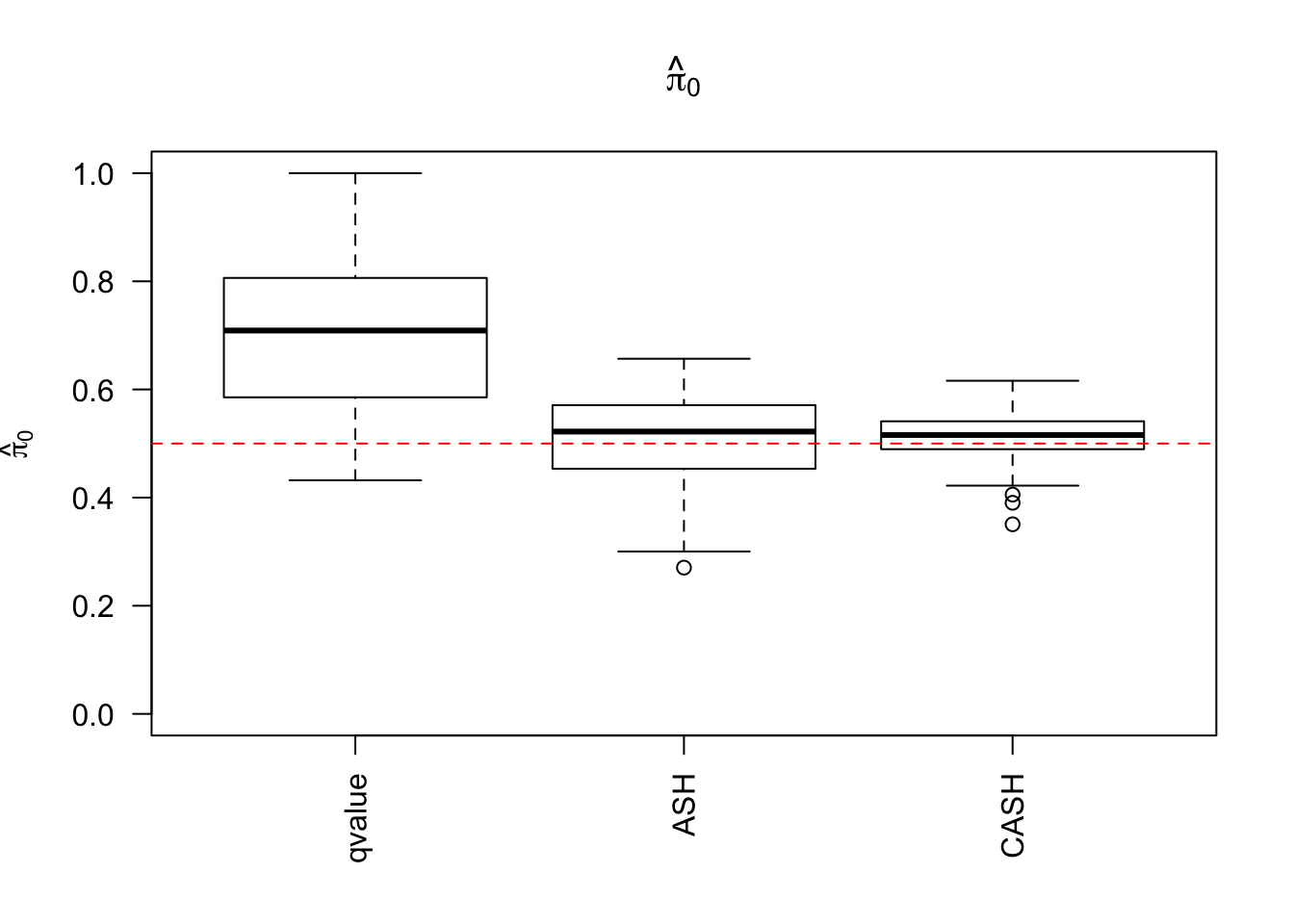

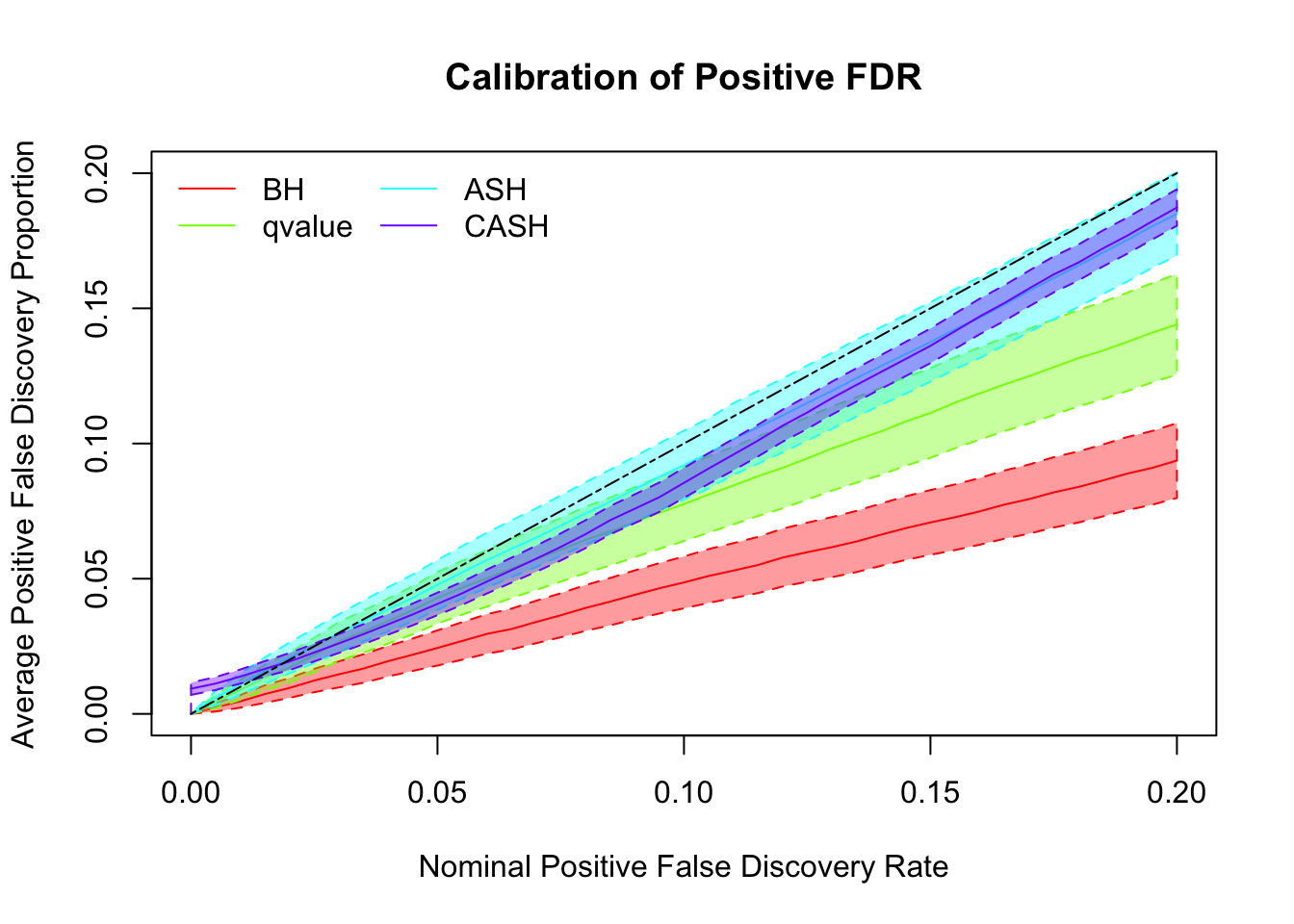

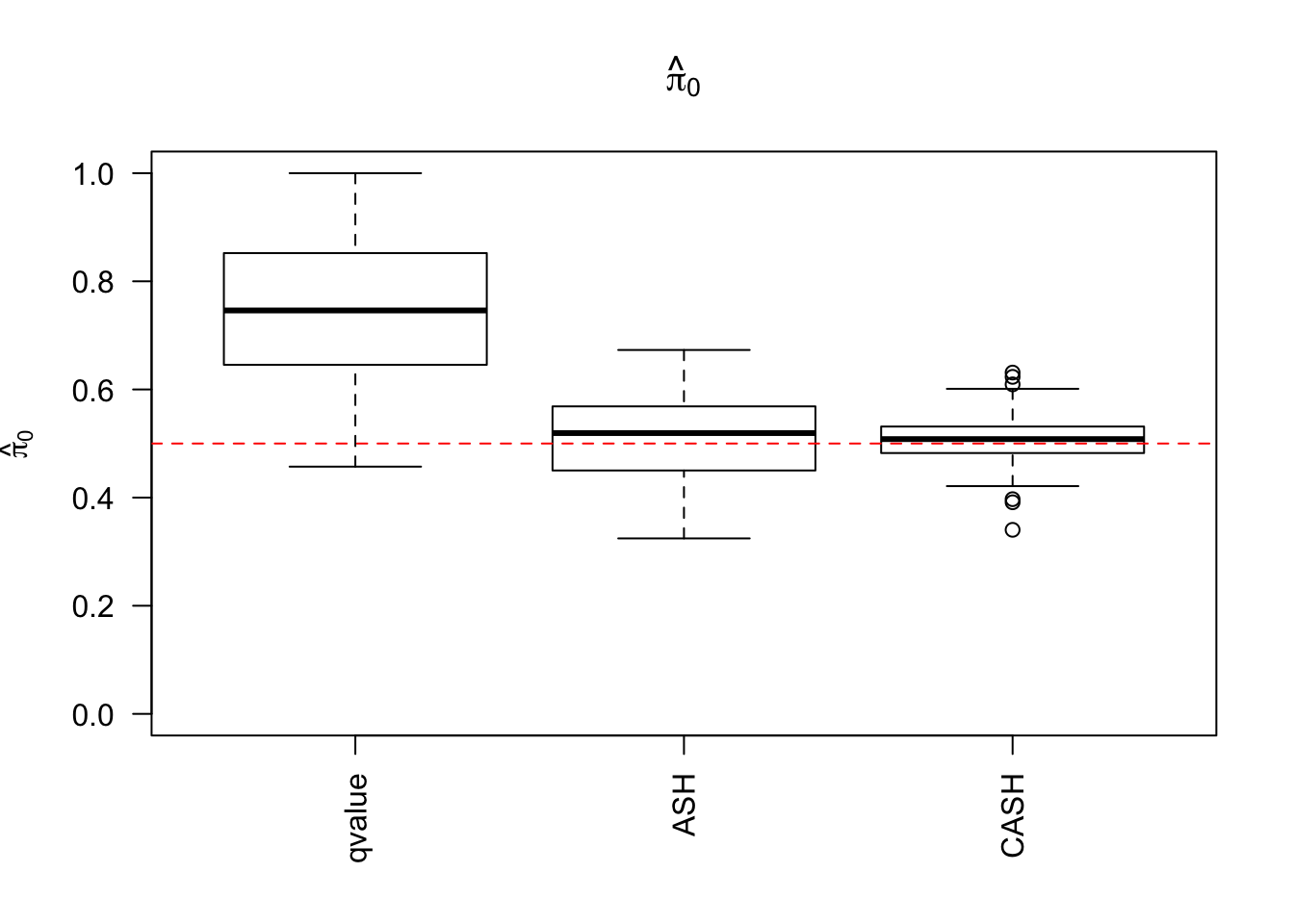

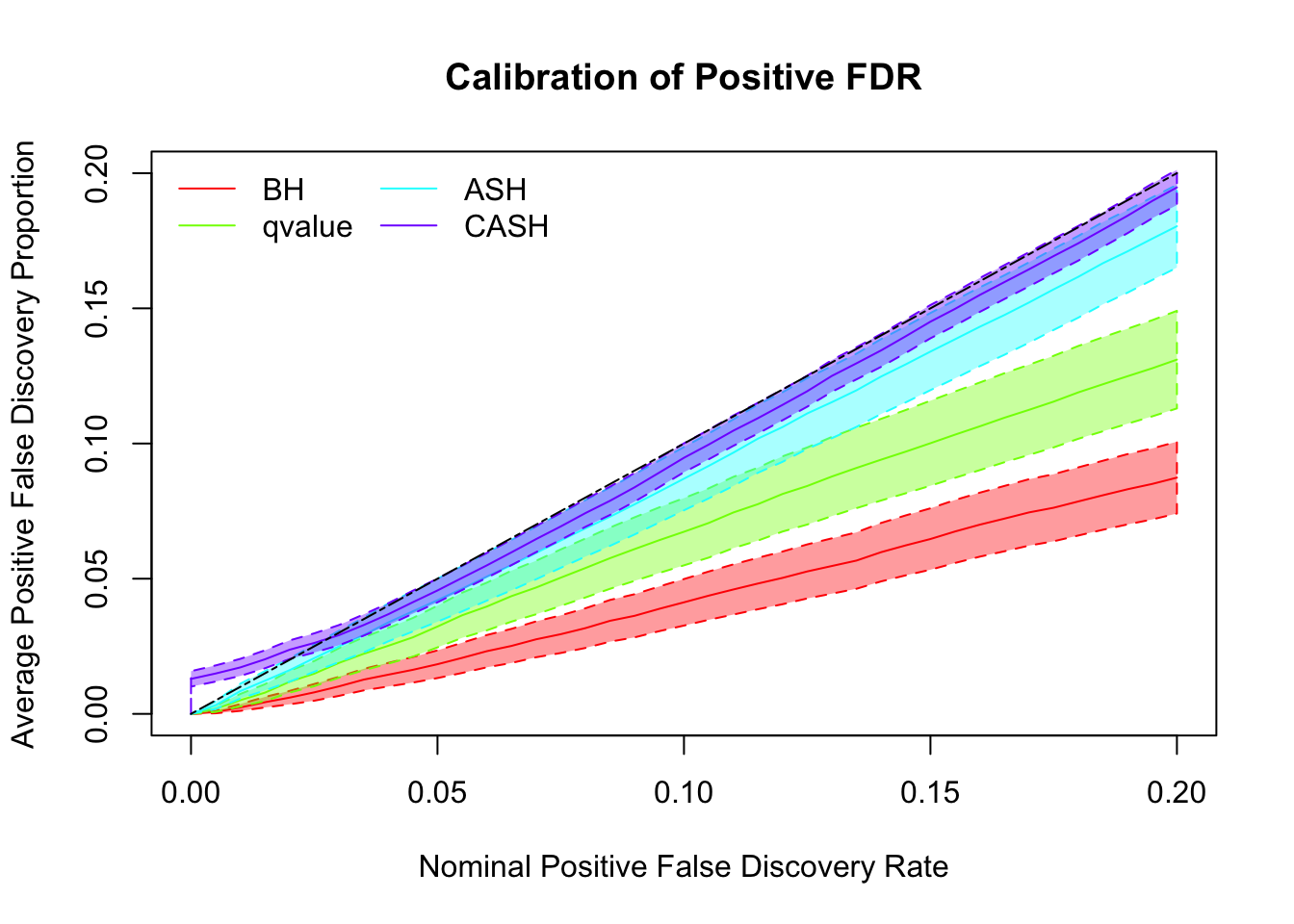

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.5, 0.3, 0.2), g.sd = c(0, 1, 2), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.5, 0.4, 0.1), g.sd = c(0, 1, 2), relative_to_noise = FALSE)

Simulation

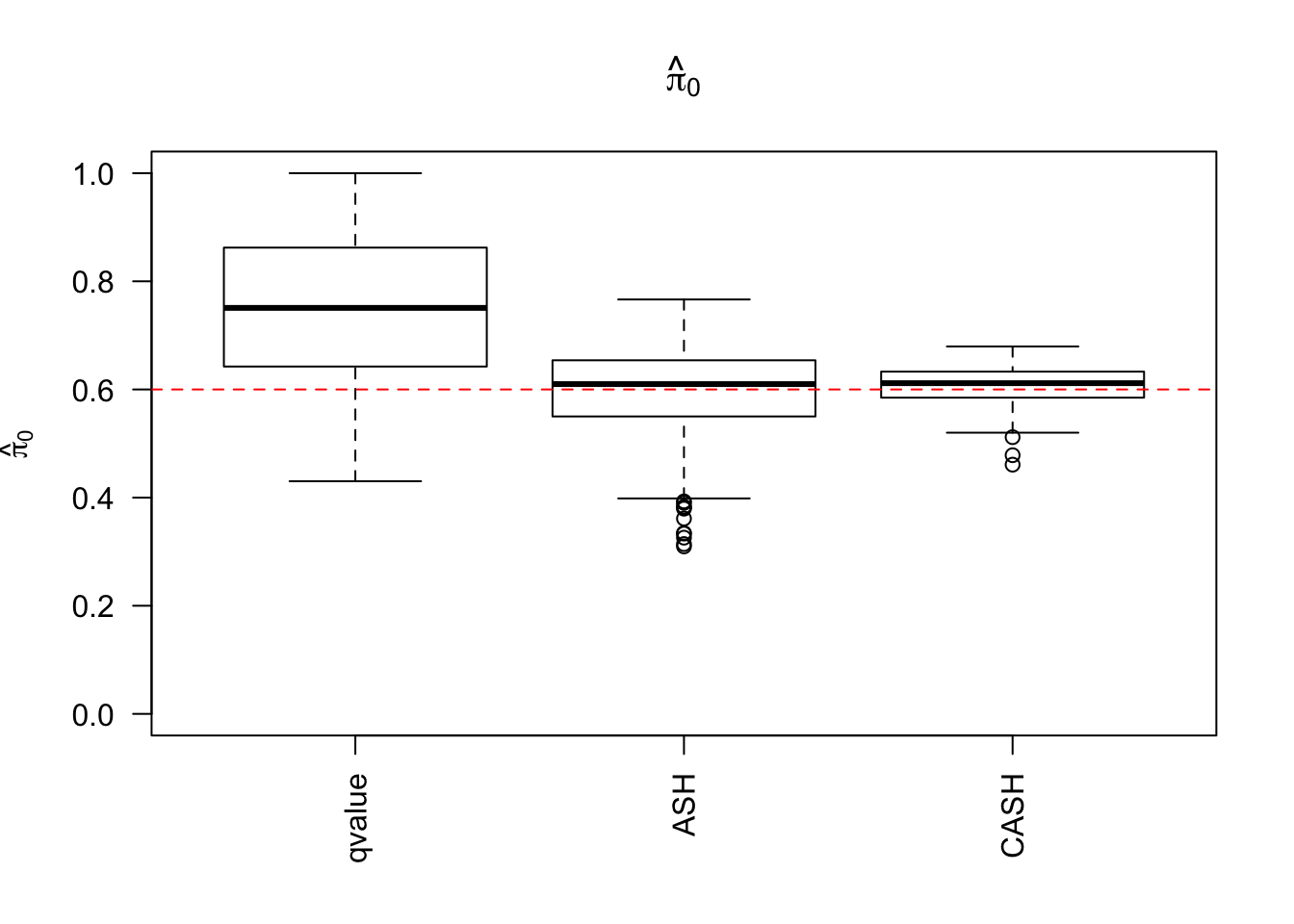

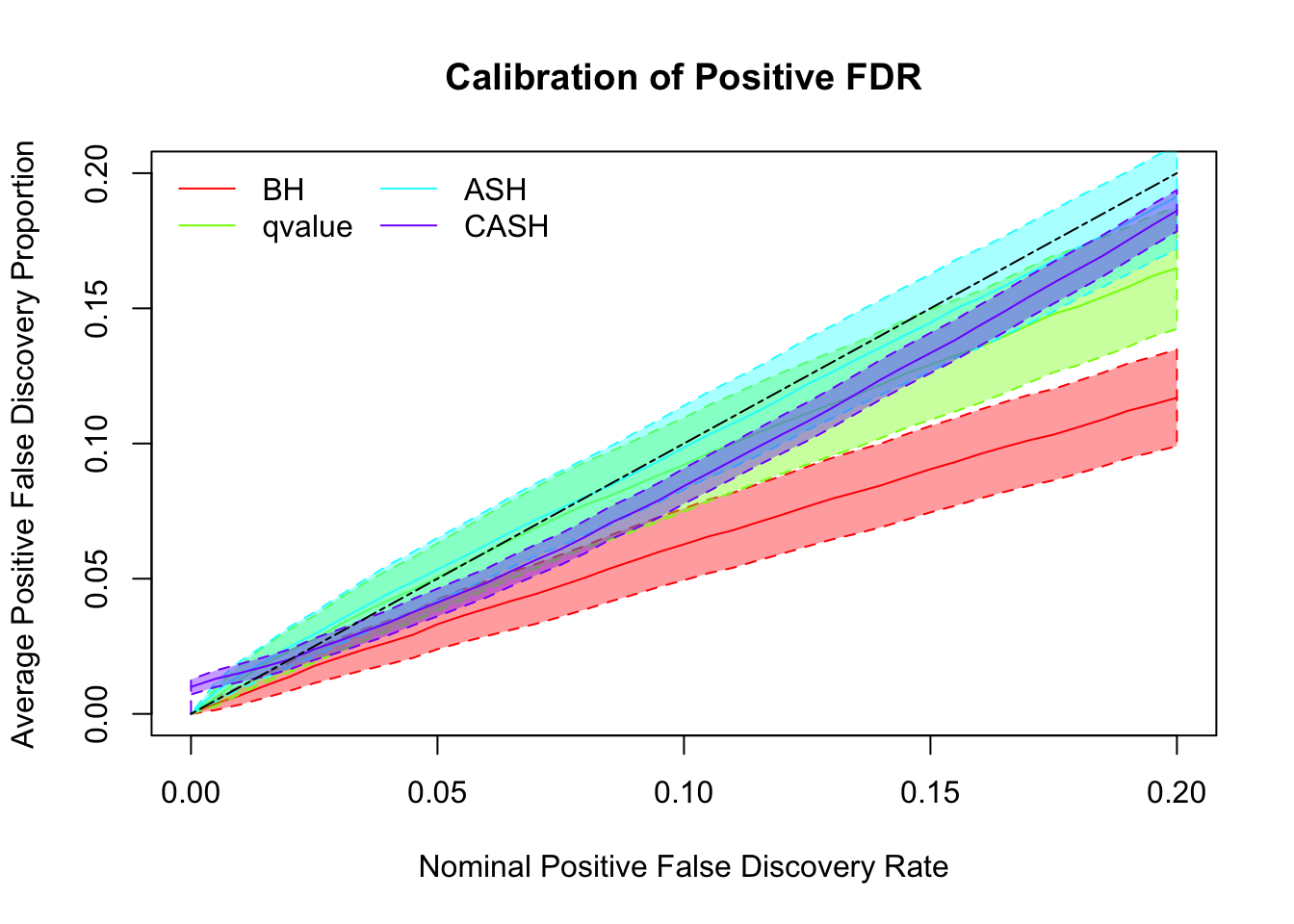

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.6, 0.3, 0.1), g.sd = c(0, 1, 2), relative_to_noise = FALSE)

Simulation

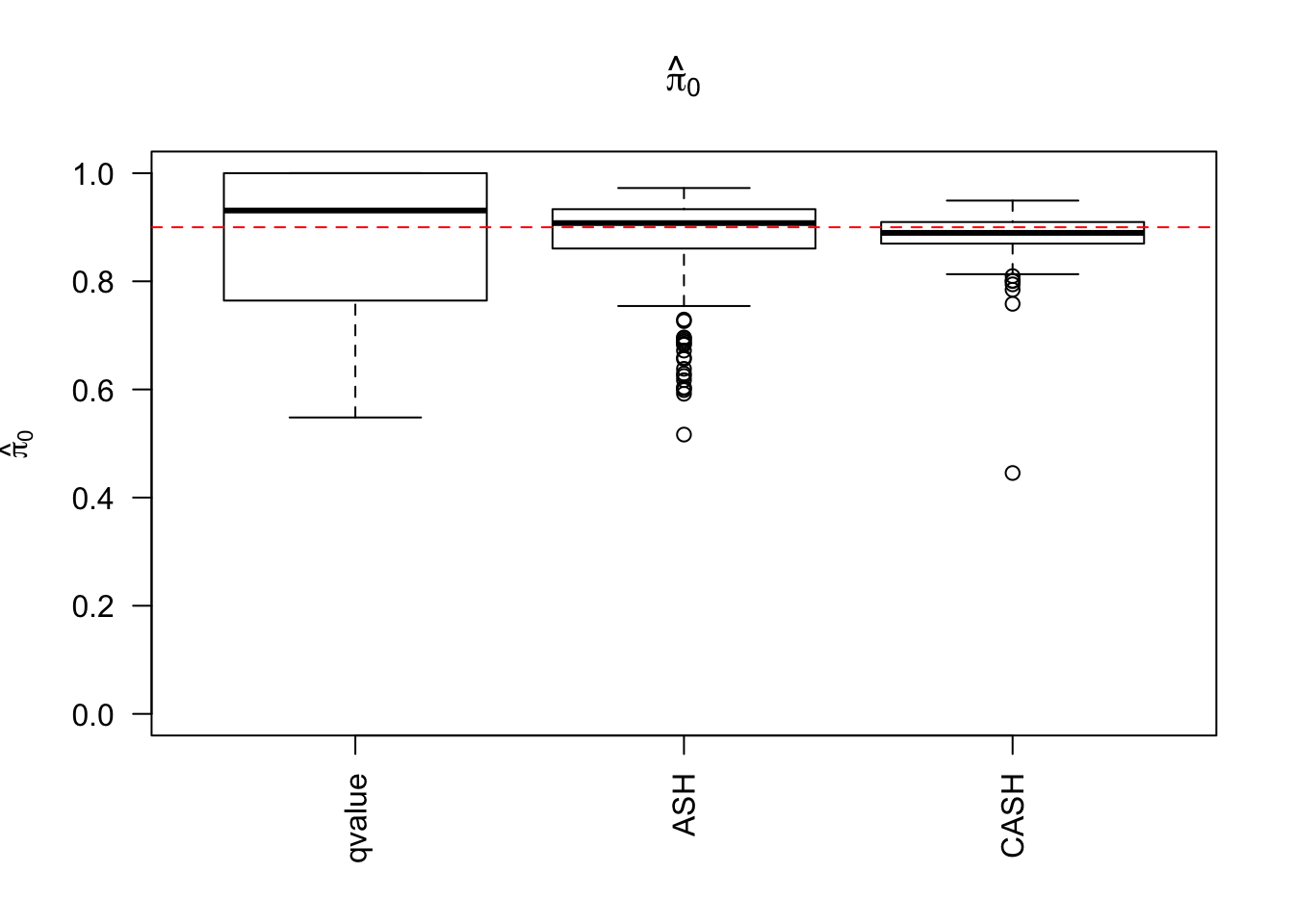

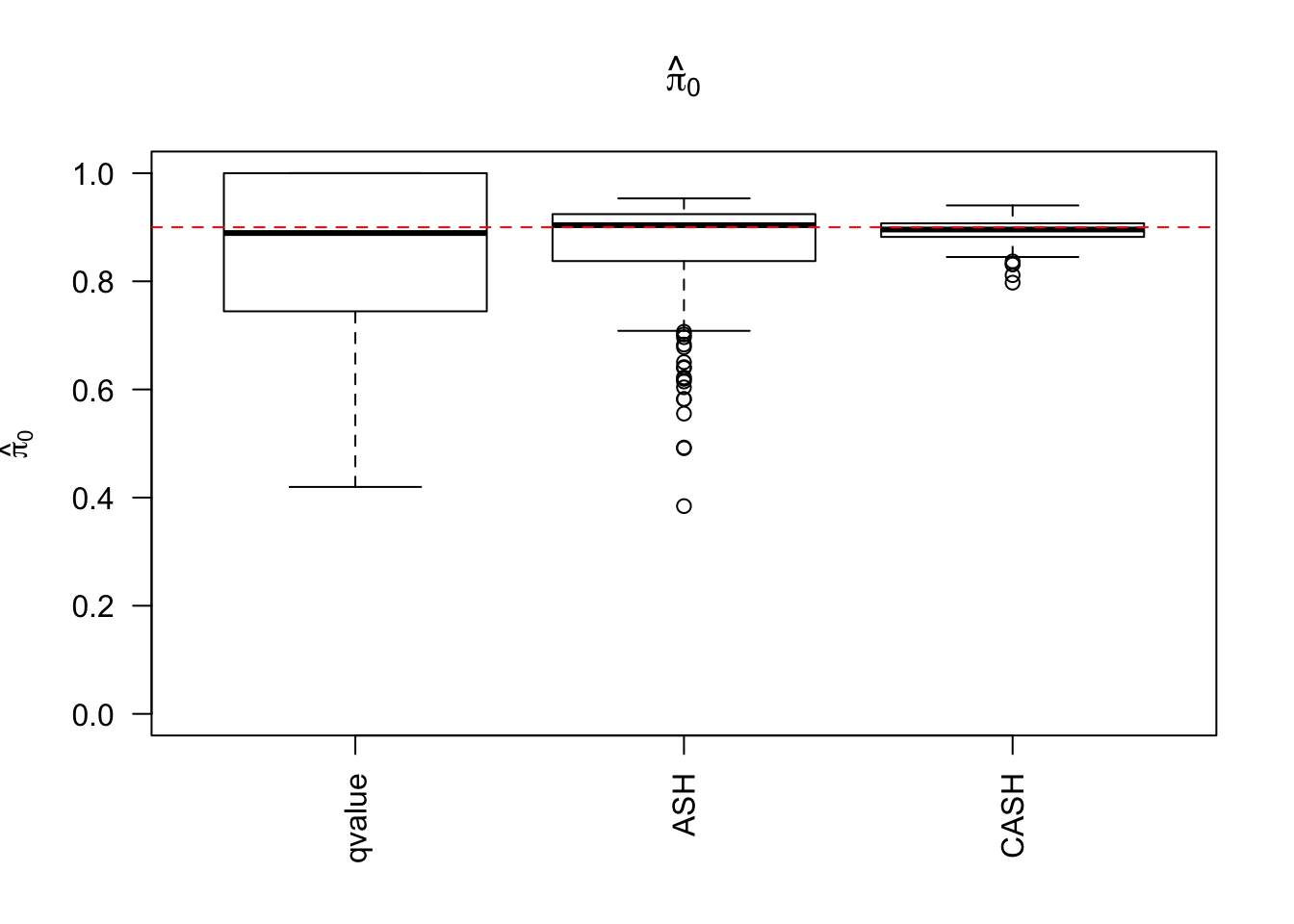

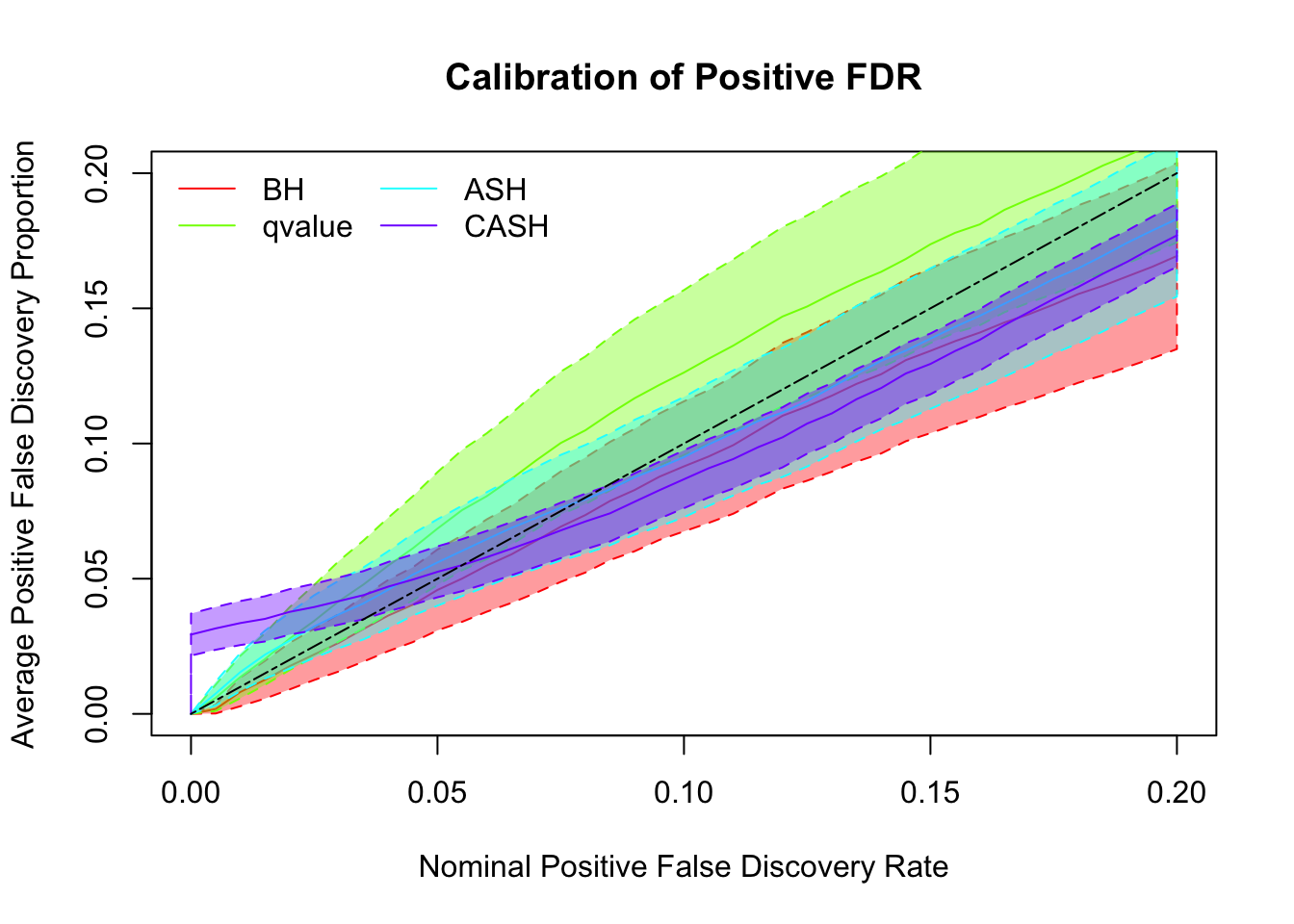

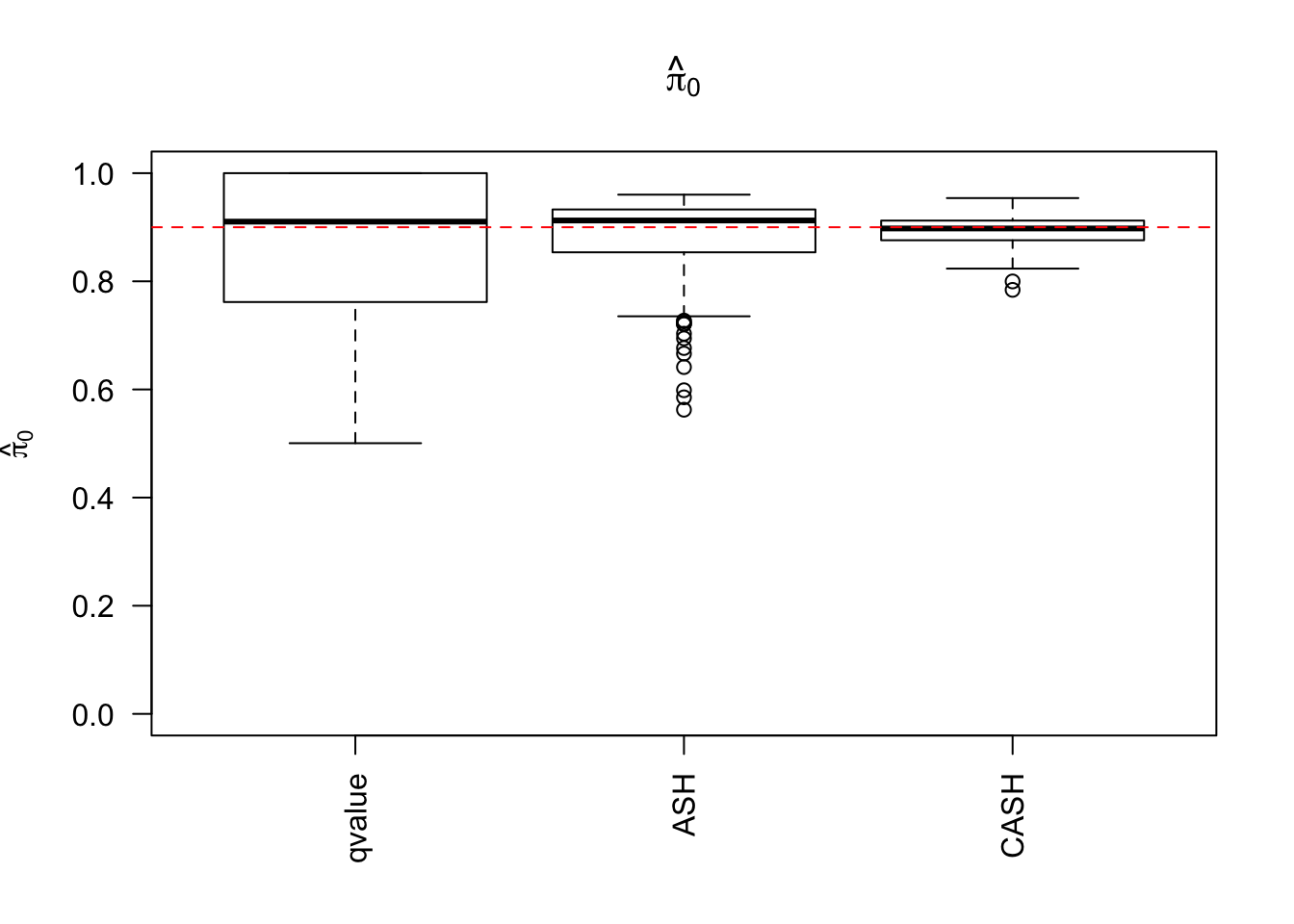

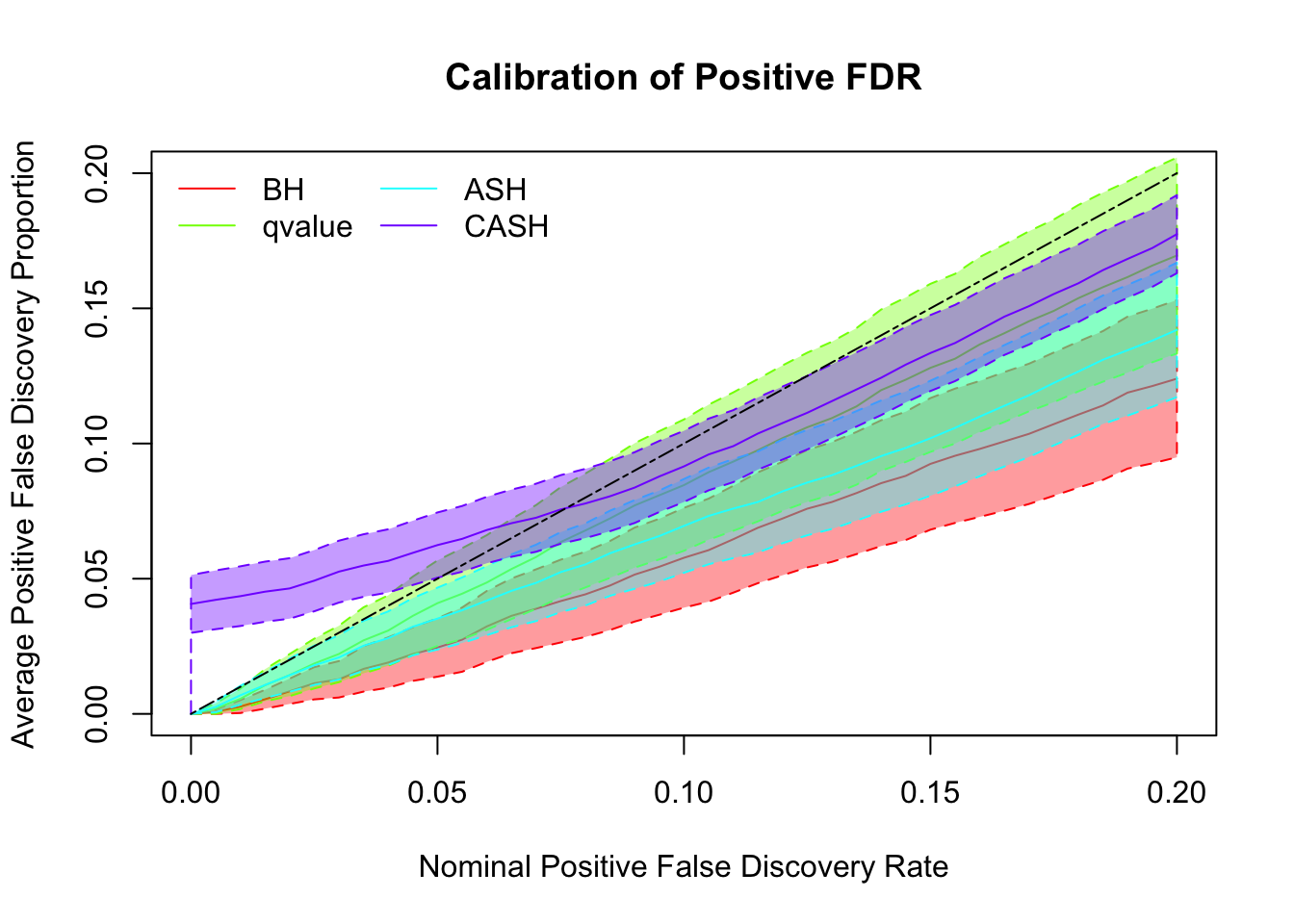

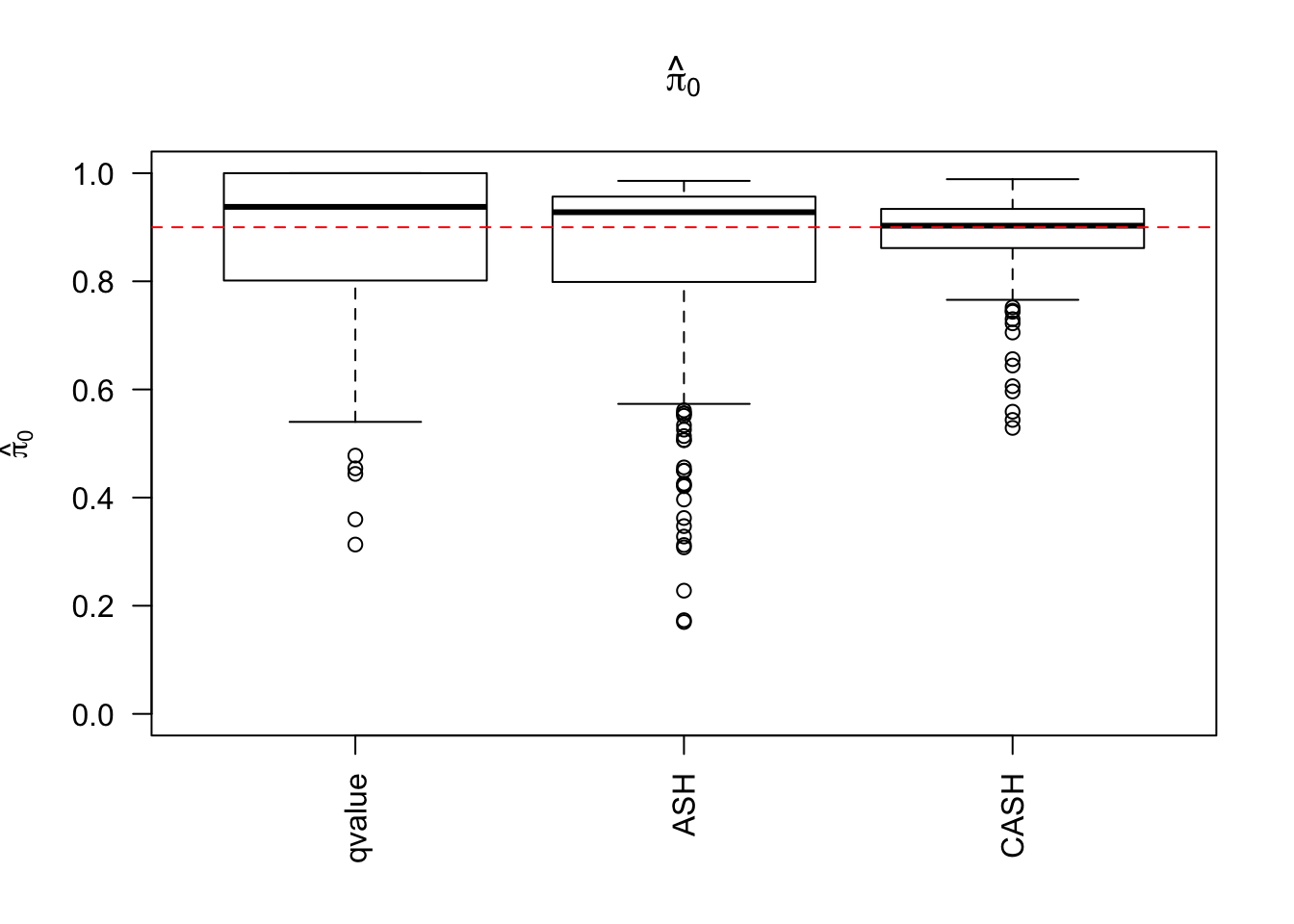

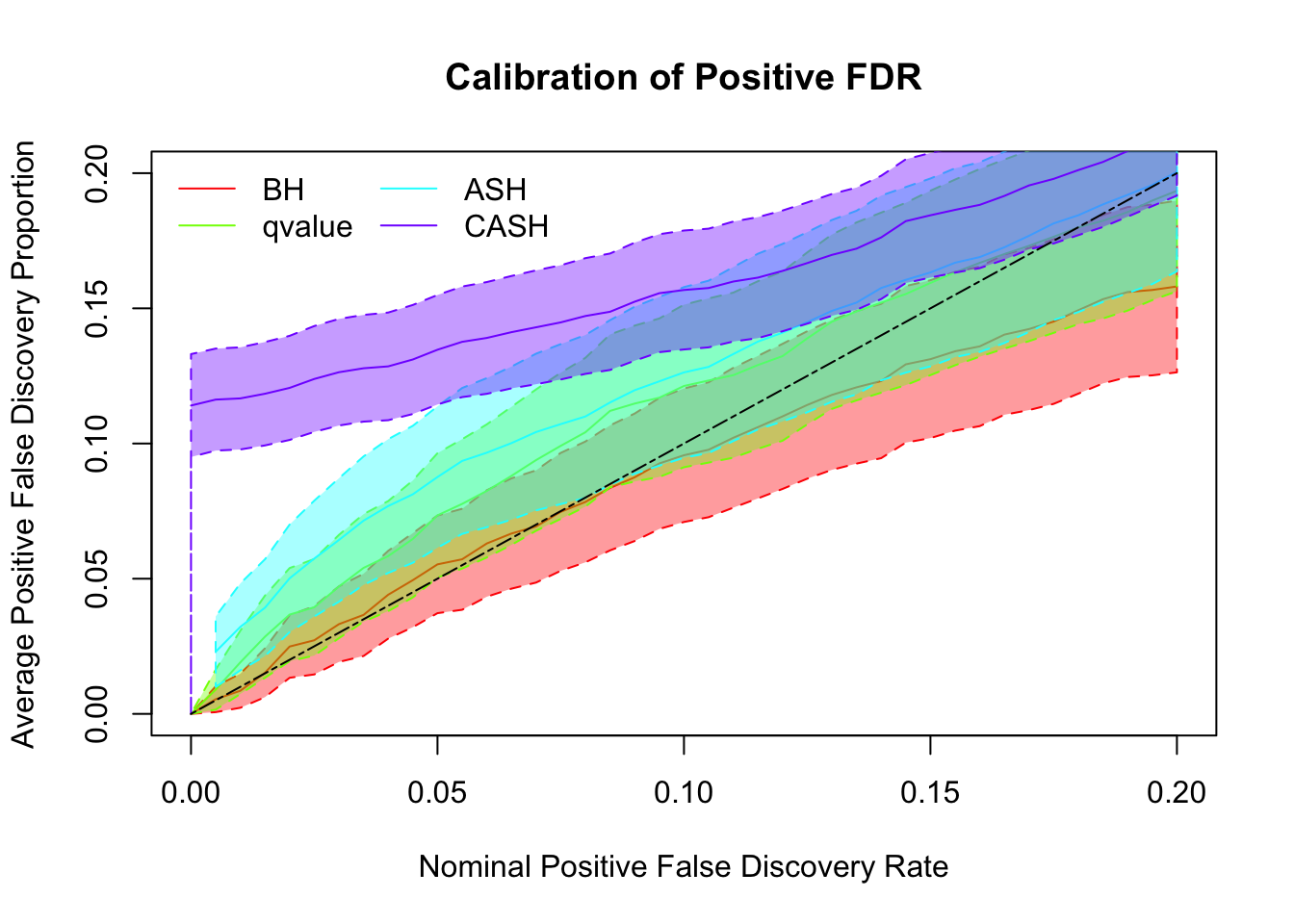

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.1), g.sd = c(0, 1), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.1), g.sd = c(0, 2), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.1), g.sd = c(0, 3), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.05, 0.05), g.sd = c(0, 1, 2), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.05, 0.05), g.sd = c(0, 1, 3), relative_to_noise = FALSE)

Simulation

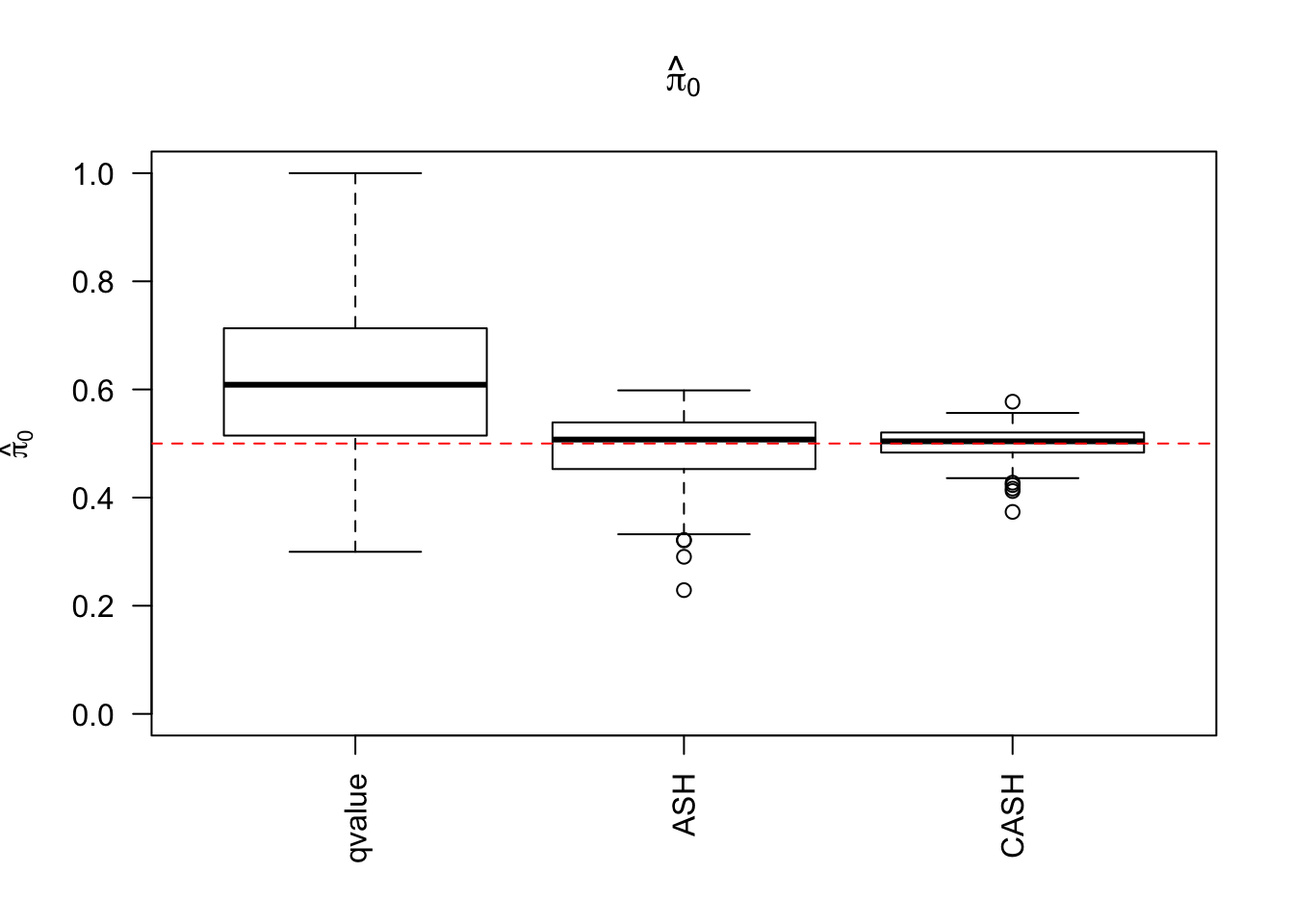

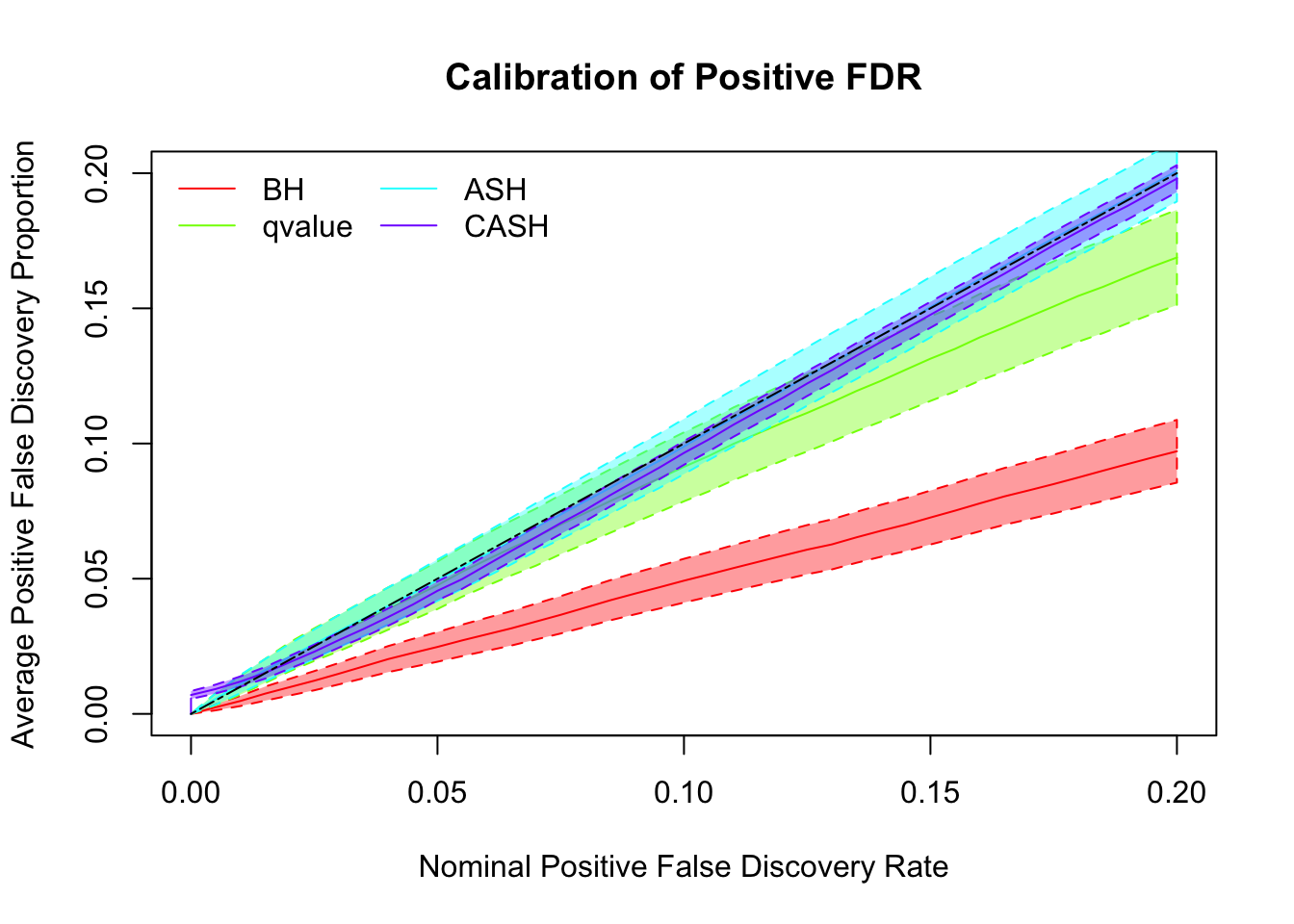

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.5, 0.5), g.sd = c(0, 1), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.5, 0.5), g.sd = c(0, 2), relative_to_noise = FALSE)

Simulation

cashSim(z.mat, se.mat,

nsim = 200, ngene = 1000,

g.pi = c(0.5, 0.5), g.sd = c(0, 3), relative_to_noise = FALSE)Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Warning in REBayes::KWDual(A, rep(1, k), normalize(w), control = control): estimated mixing distribution has some negative values:

consider reducing rtol

Read data

z.real <- readRDS("../output/z_null_liver_777.rds")

se.real <- readRDS("../output/sebetahat_null_liver_777.rds")Simulation

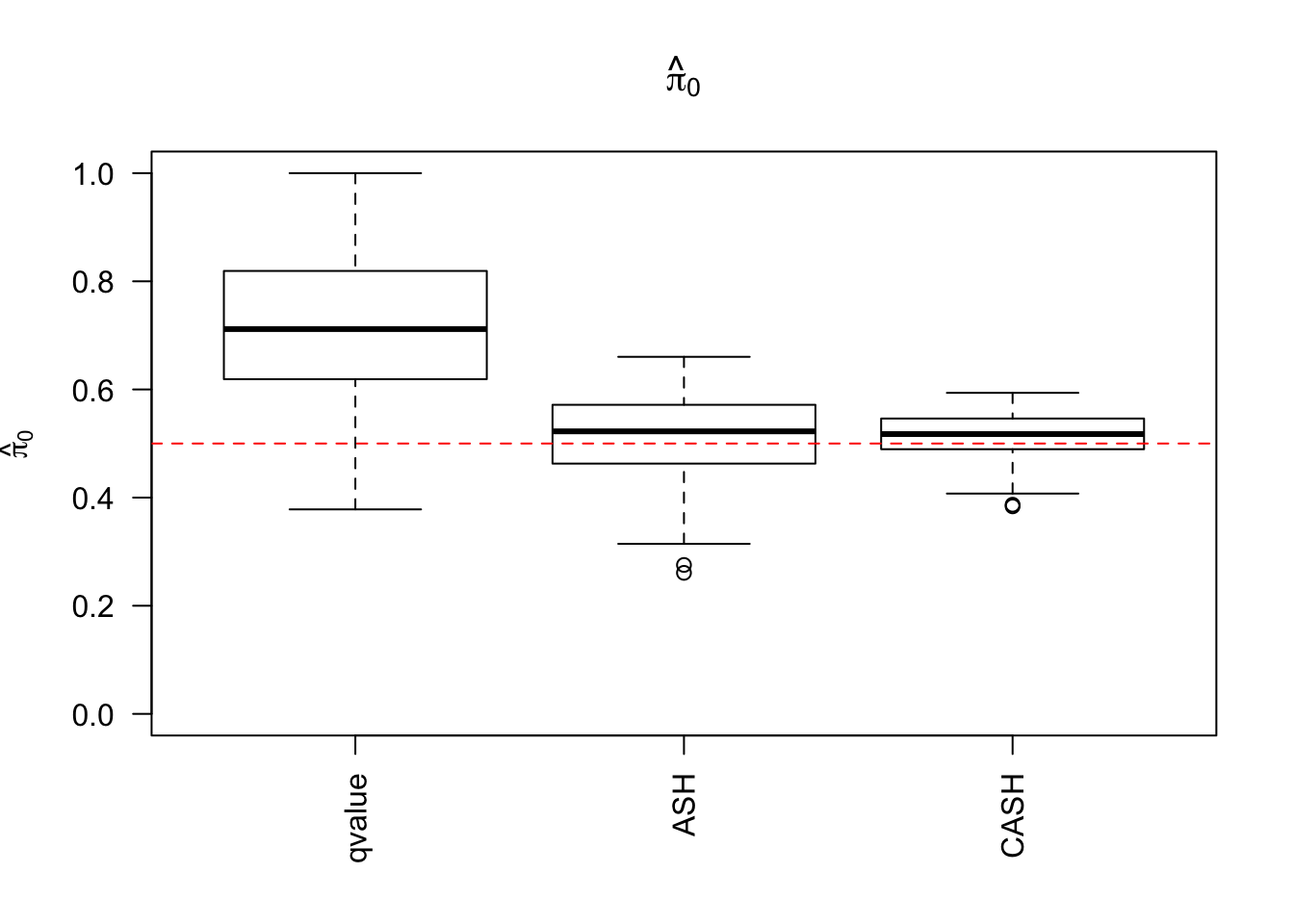

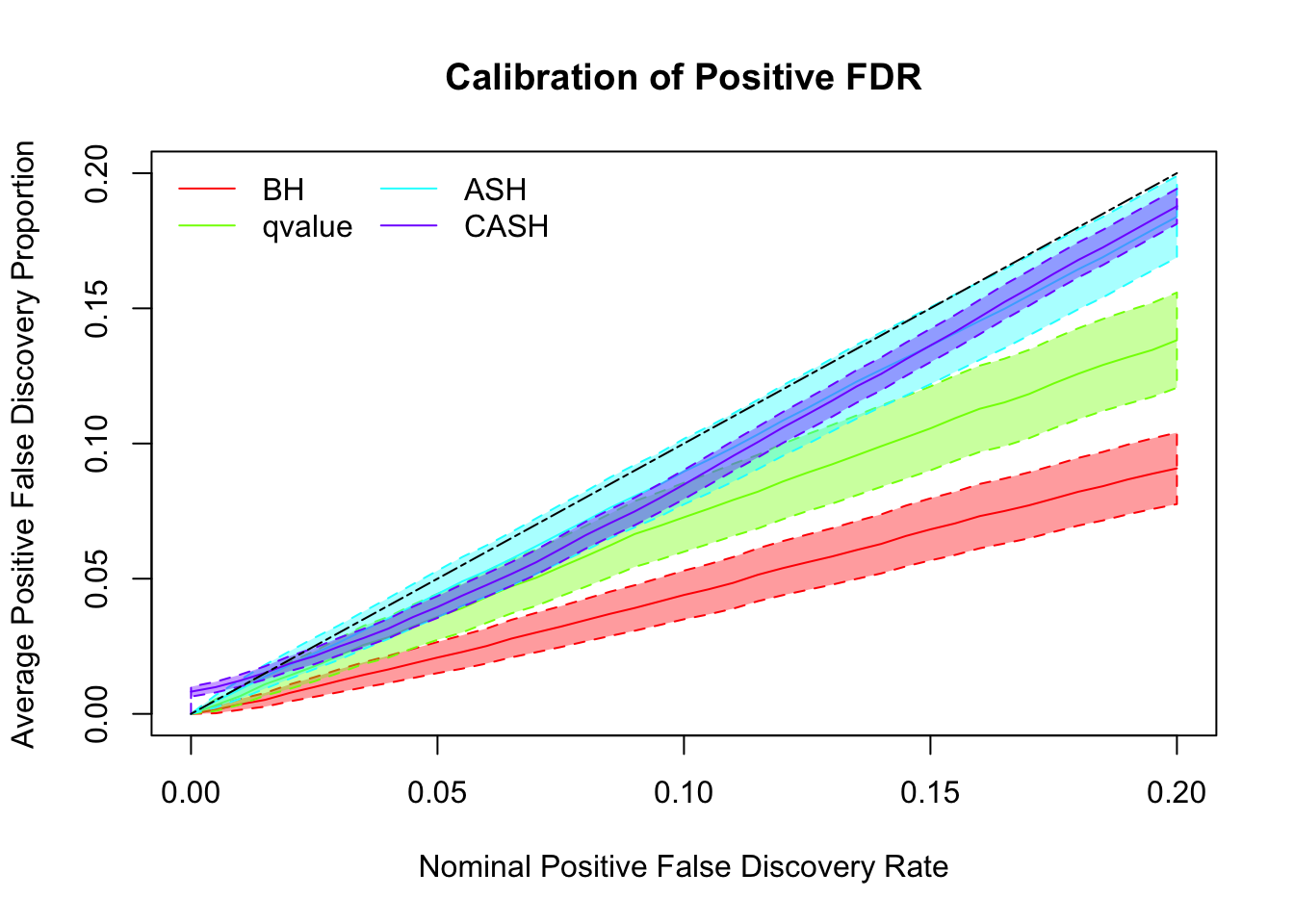

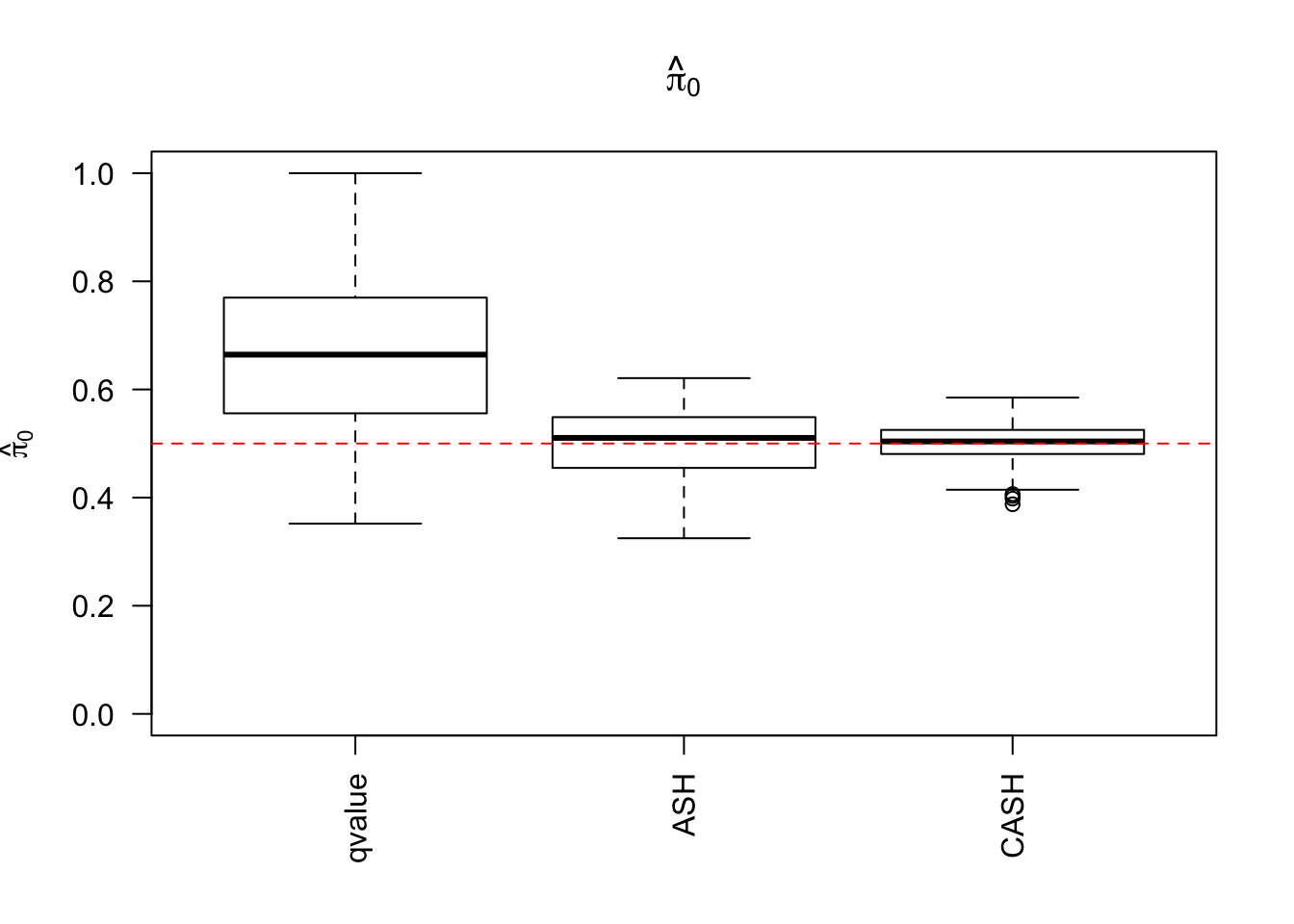

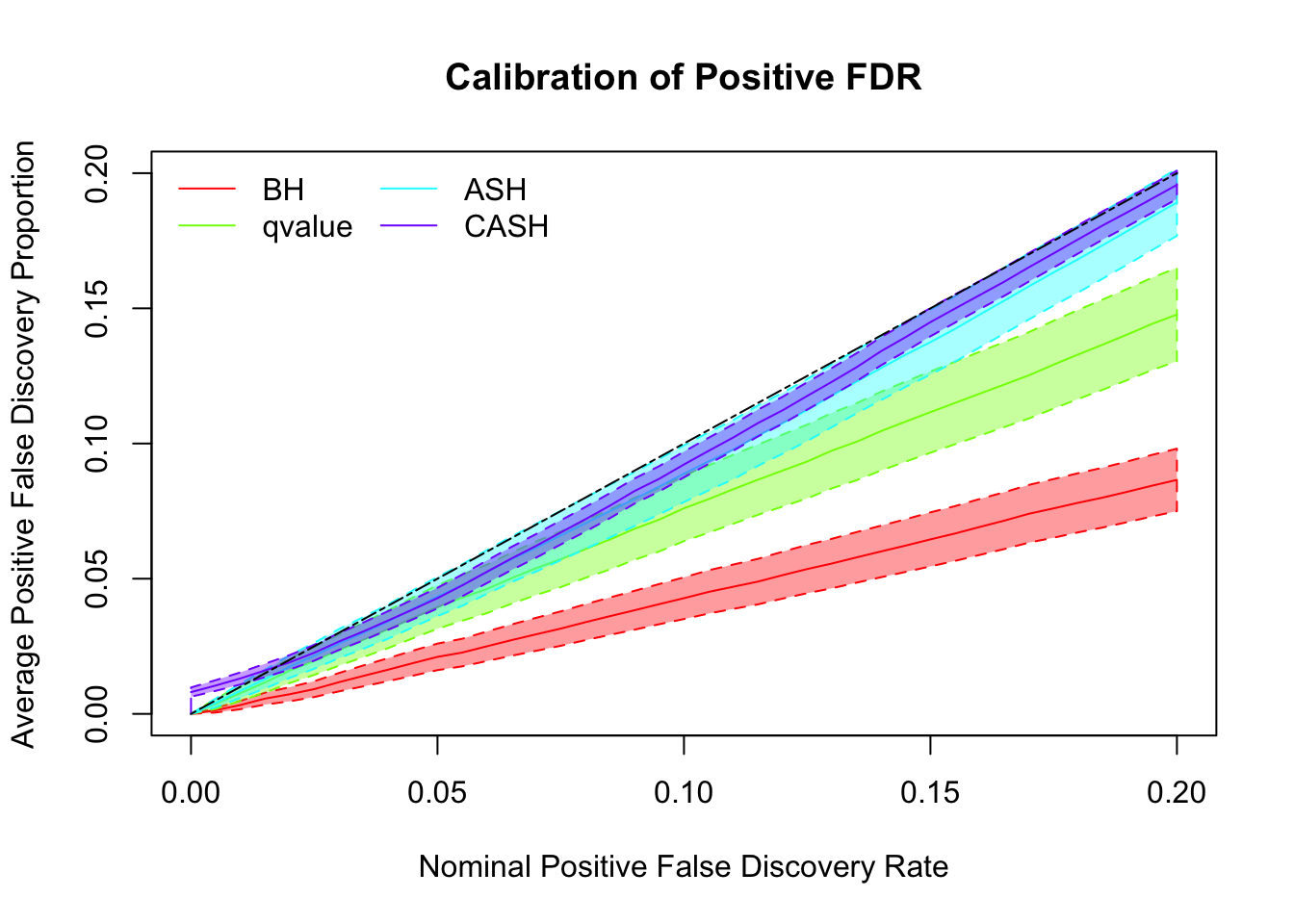

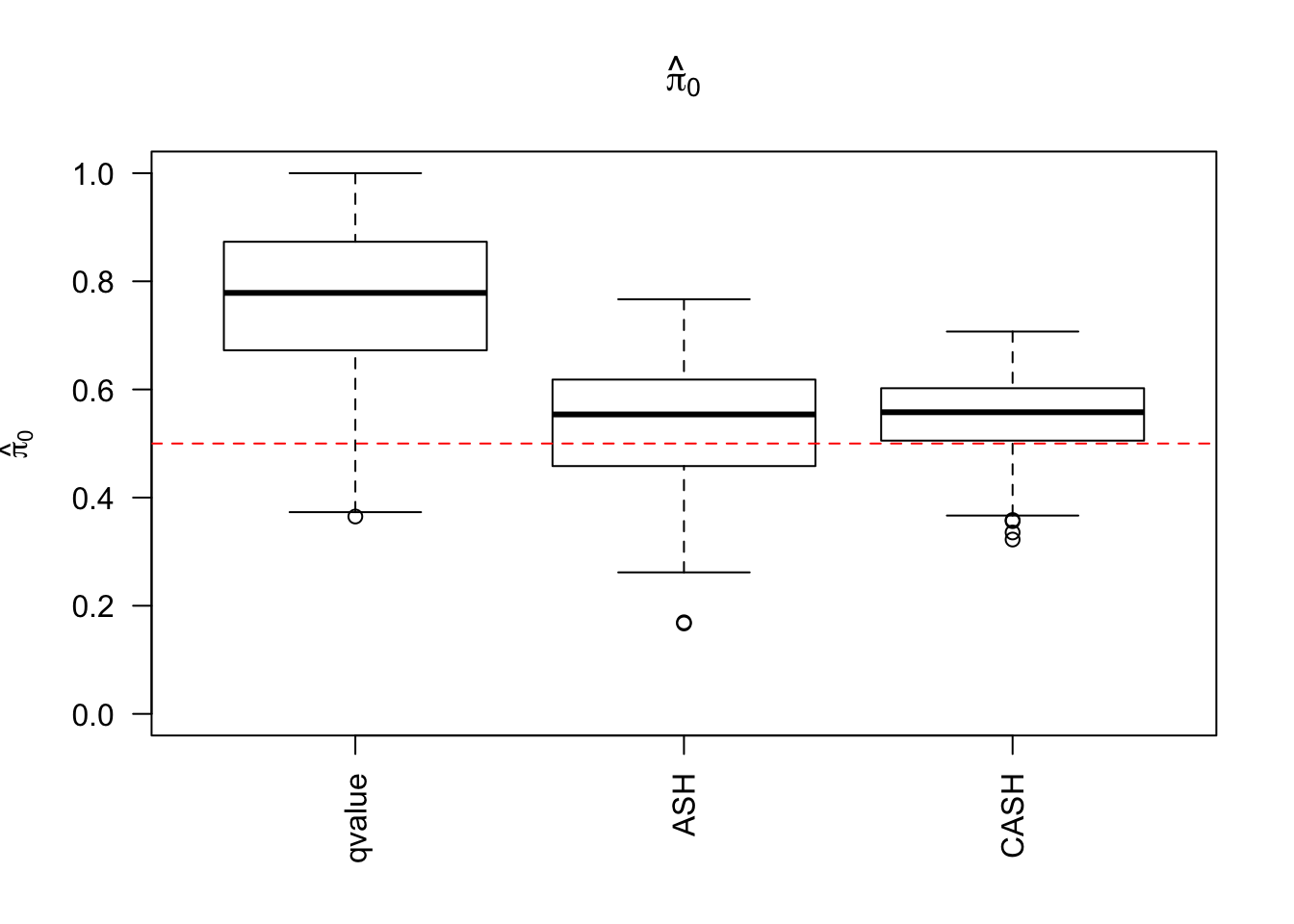

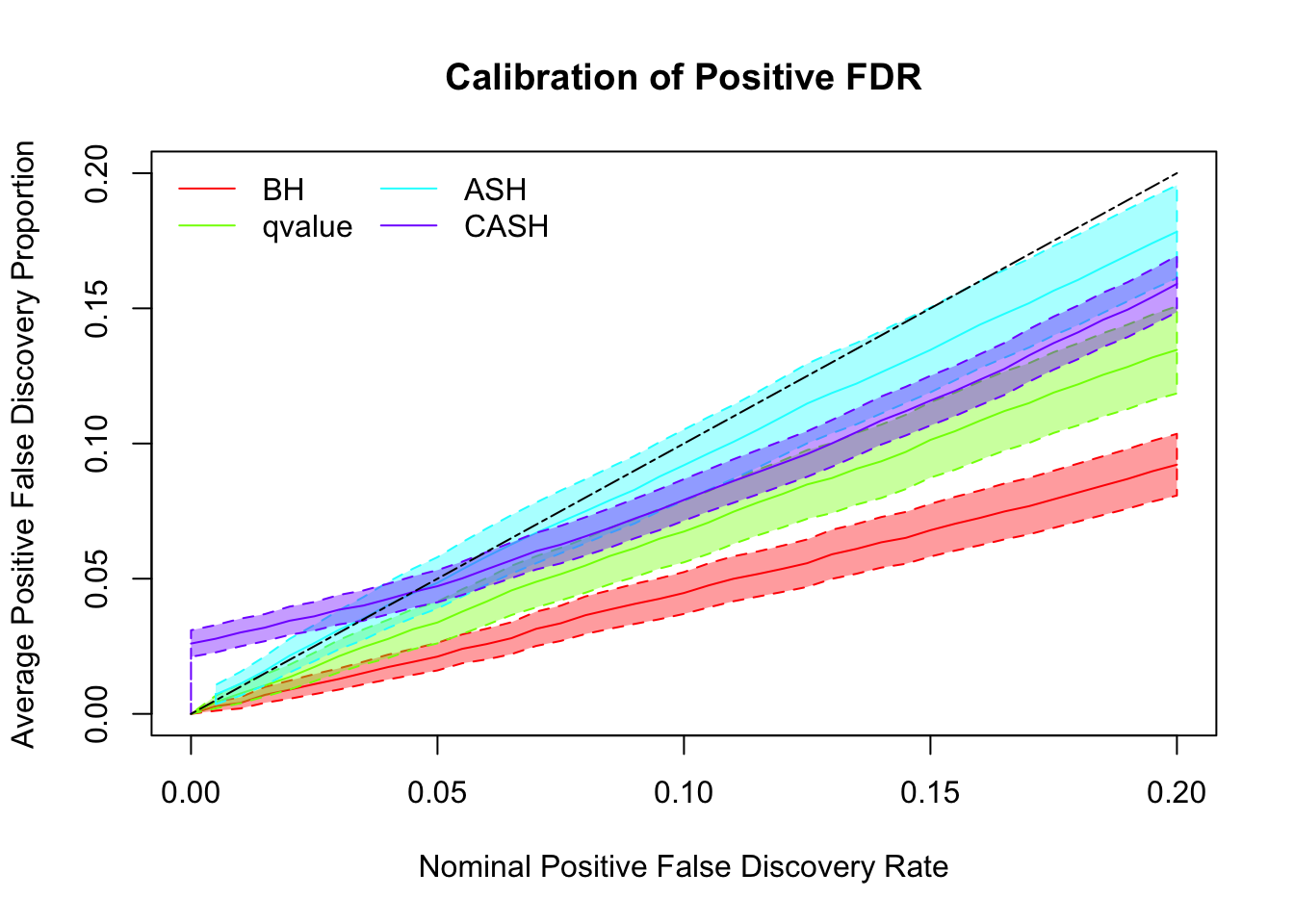

cashSim(z.real, se.real,

nsim = 200, ngene = 1000,

g.pi = c(0.5, 0.5), g.sd = c(0, 1), relative_to_noise = TRUE)

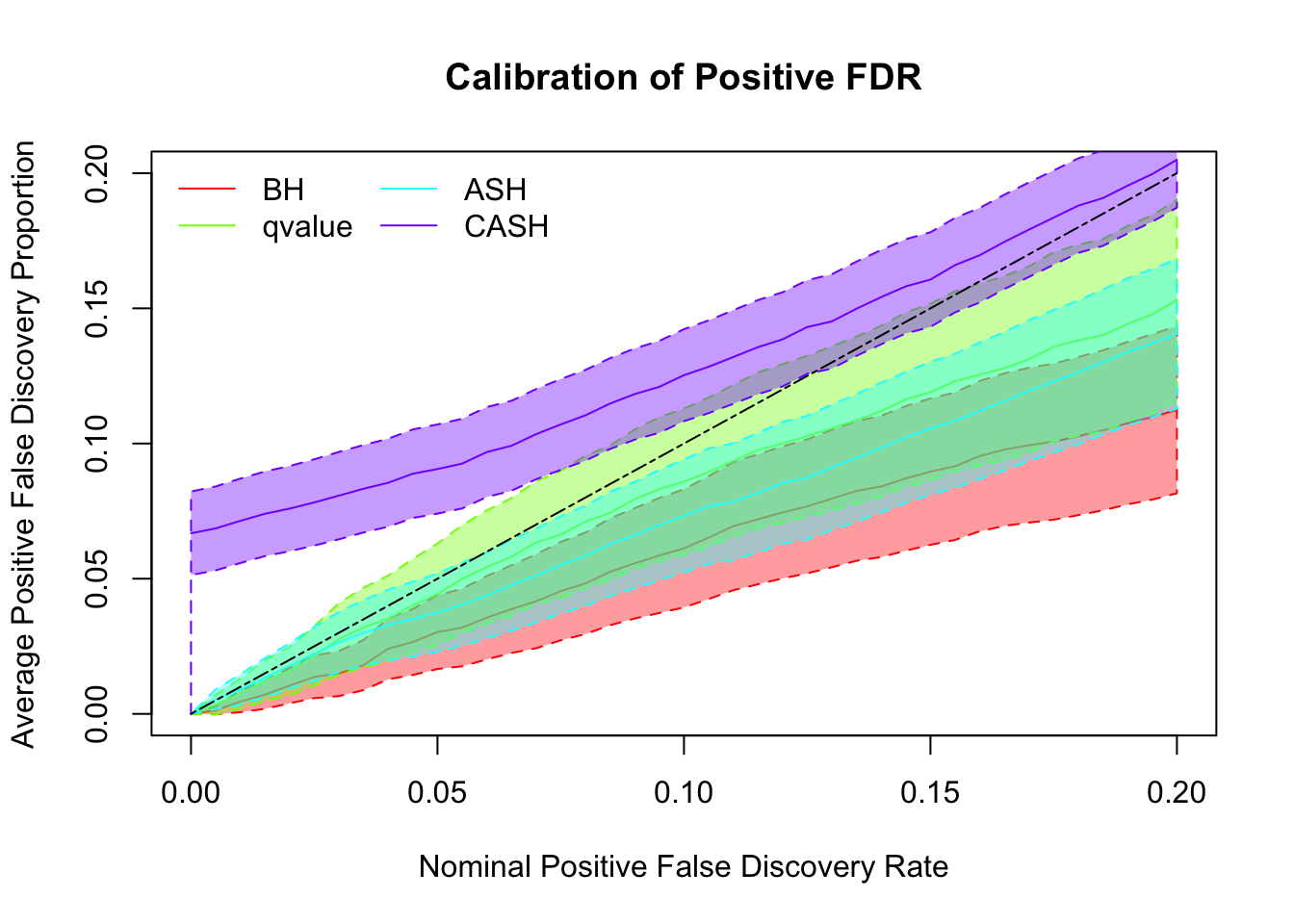

Simulation

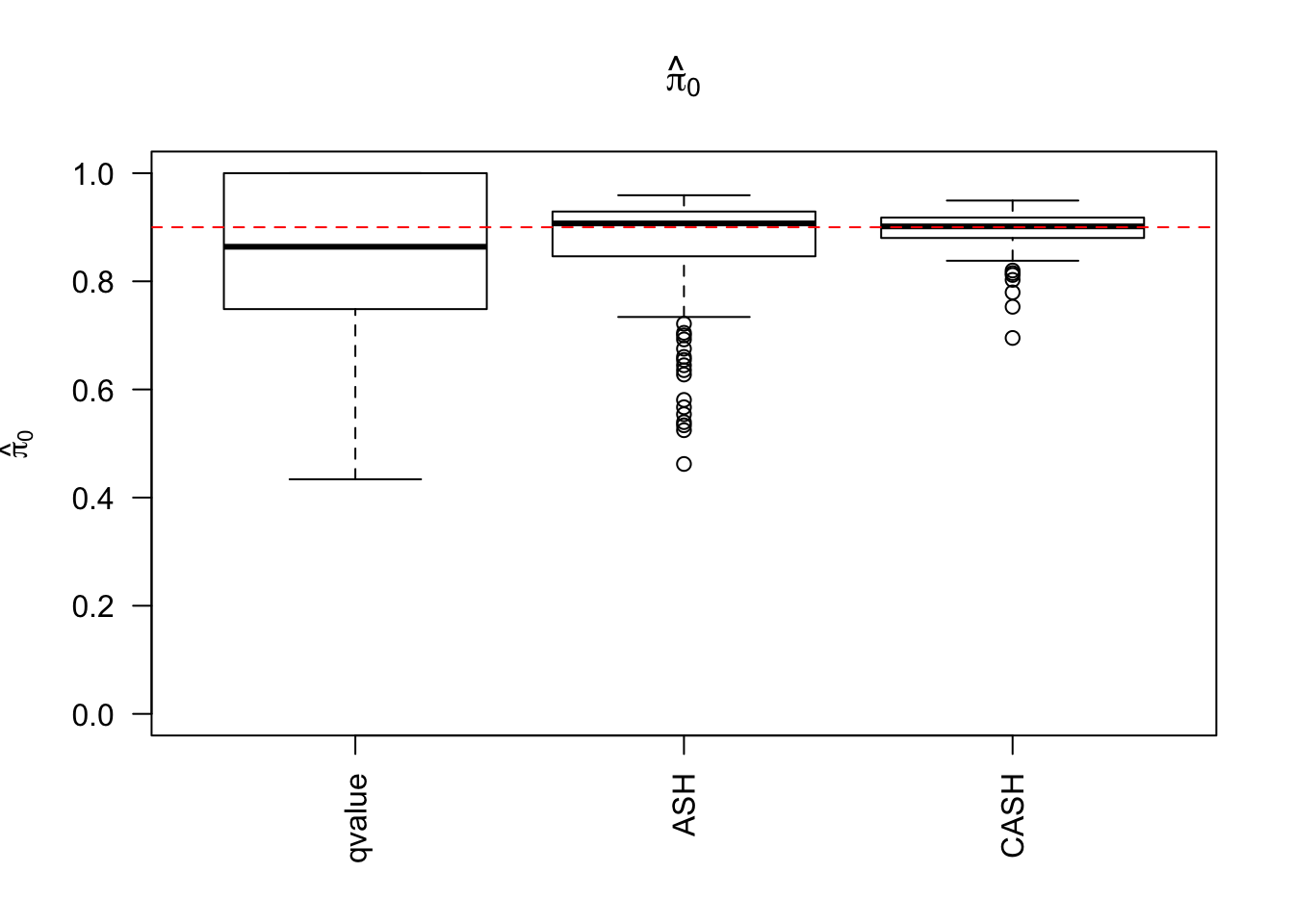

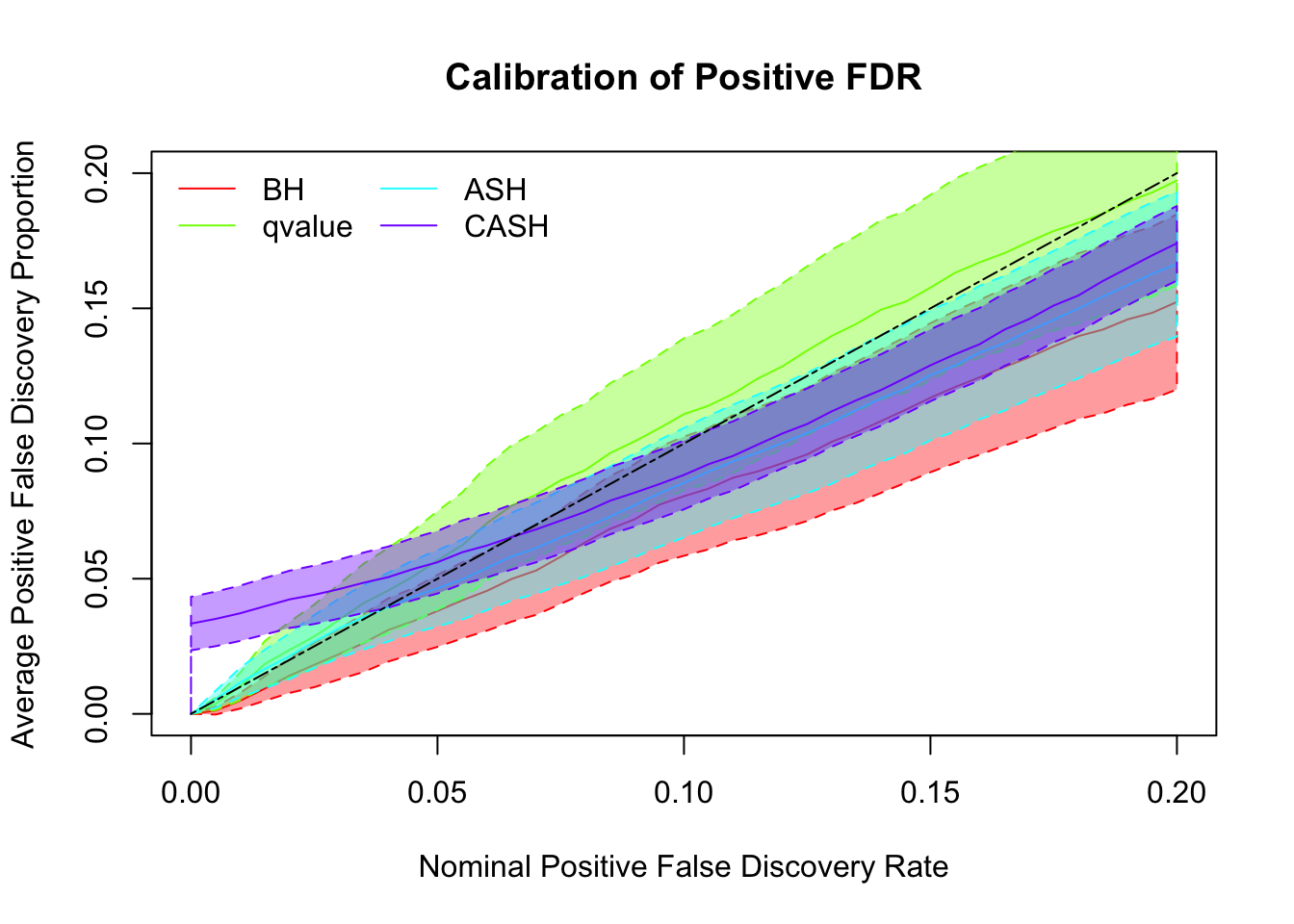

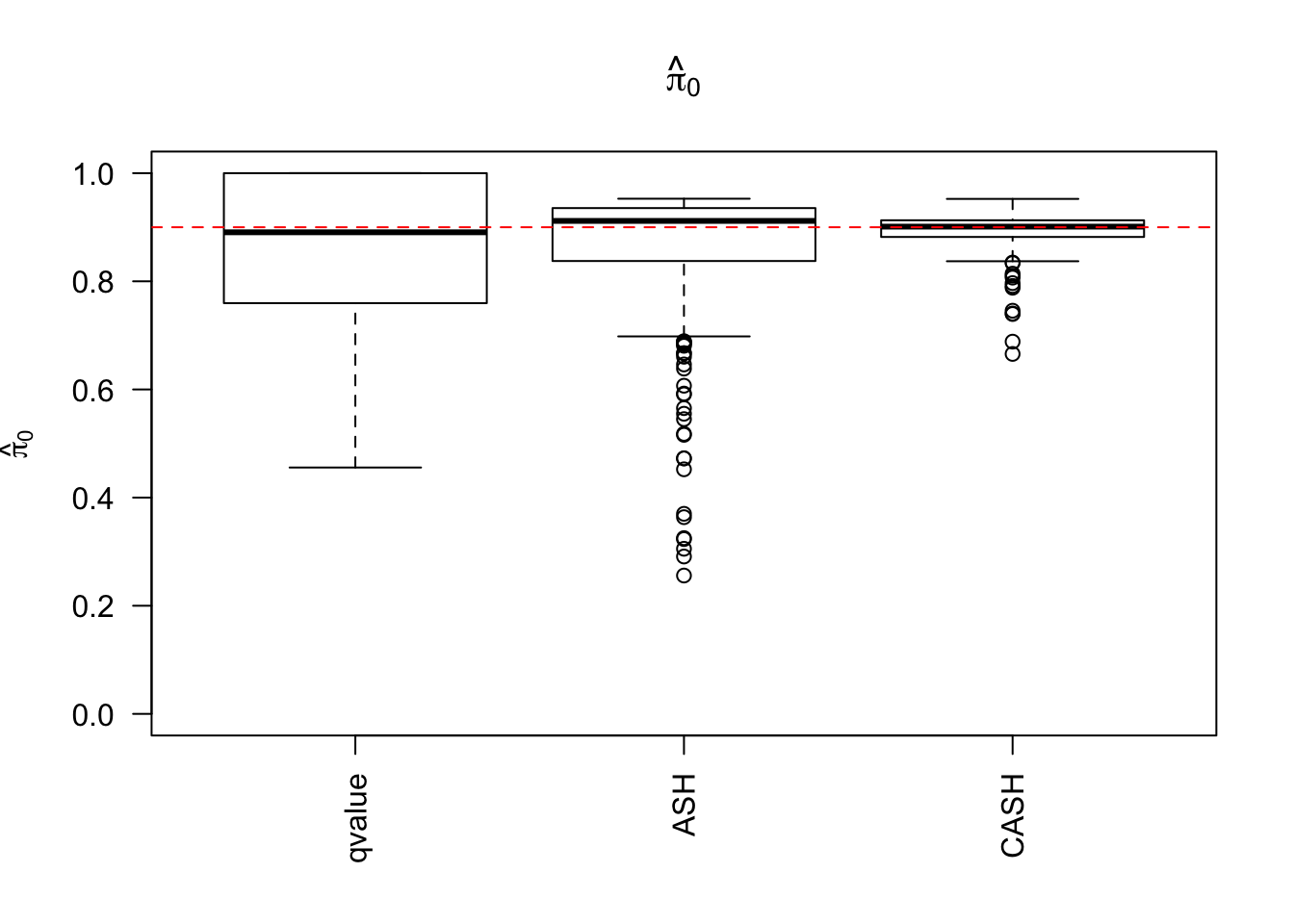

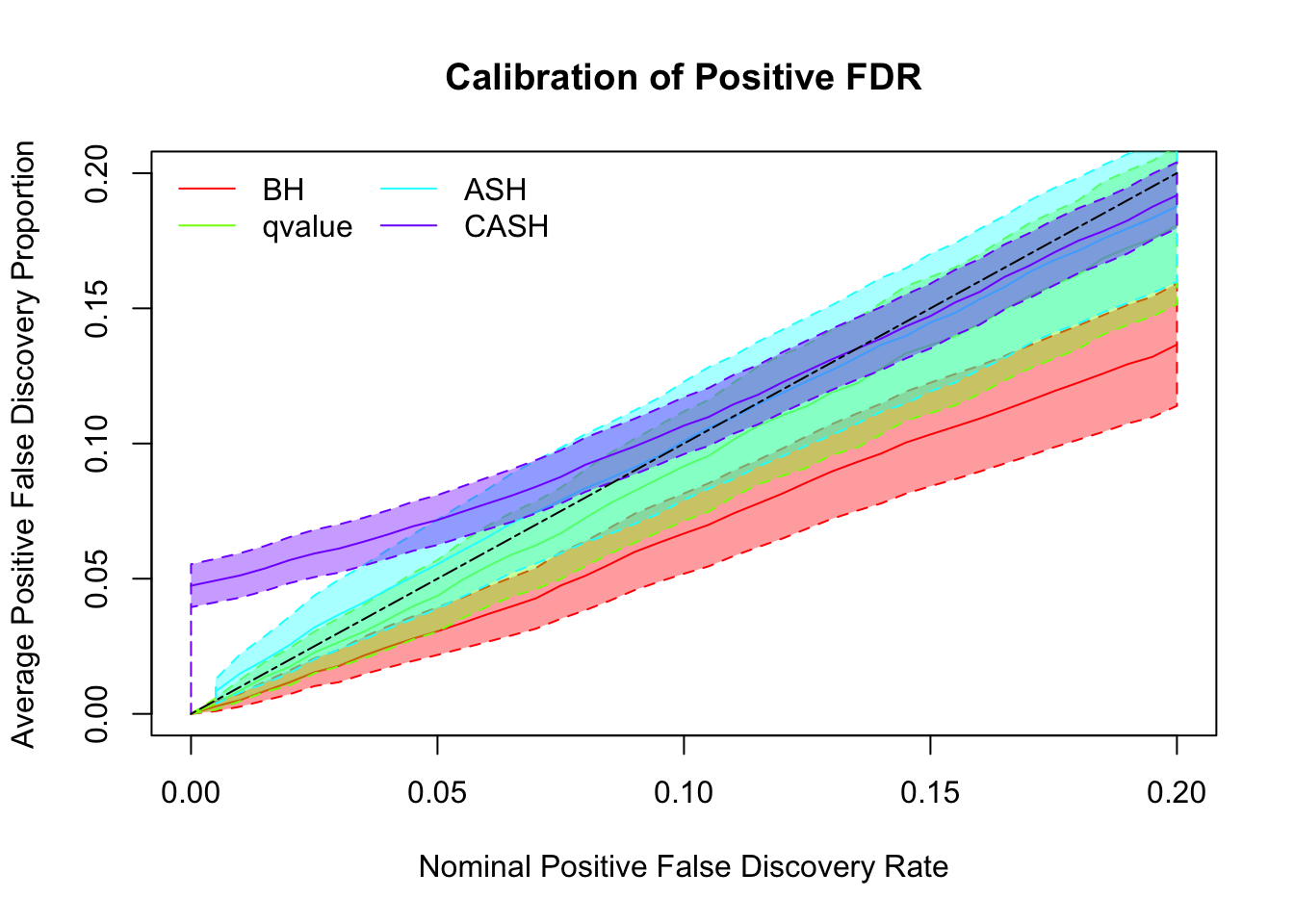

cashSim(z.real, se.real,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.1), g.sd = c(0, 1), relative_to_noise = TRUE)

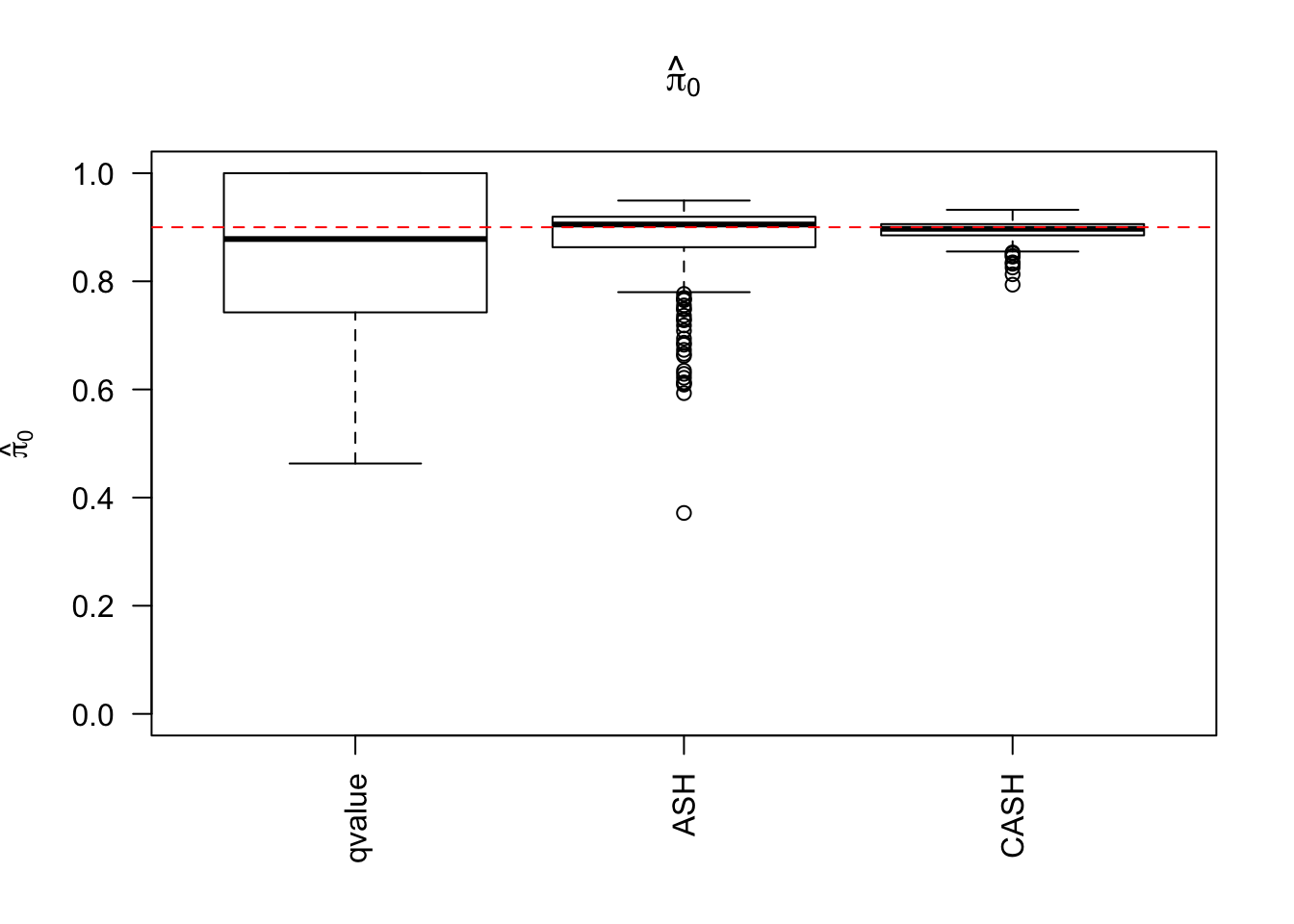

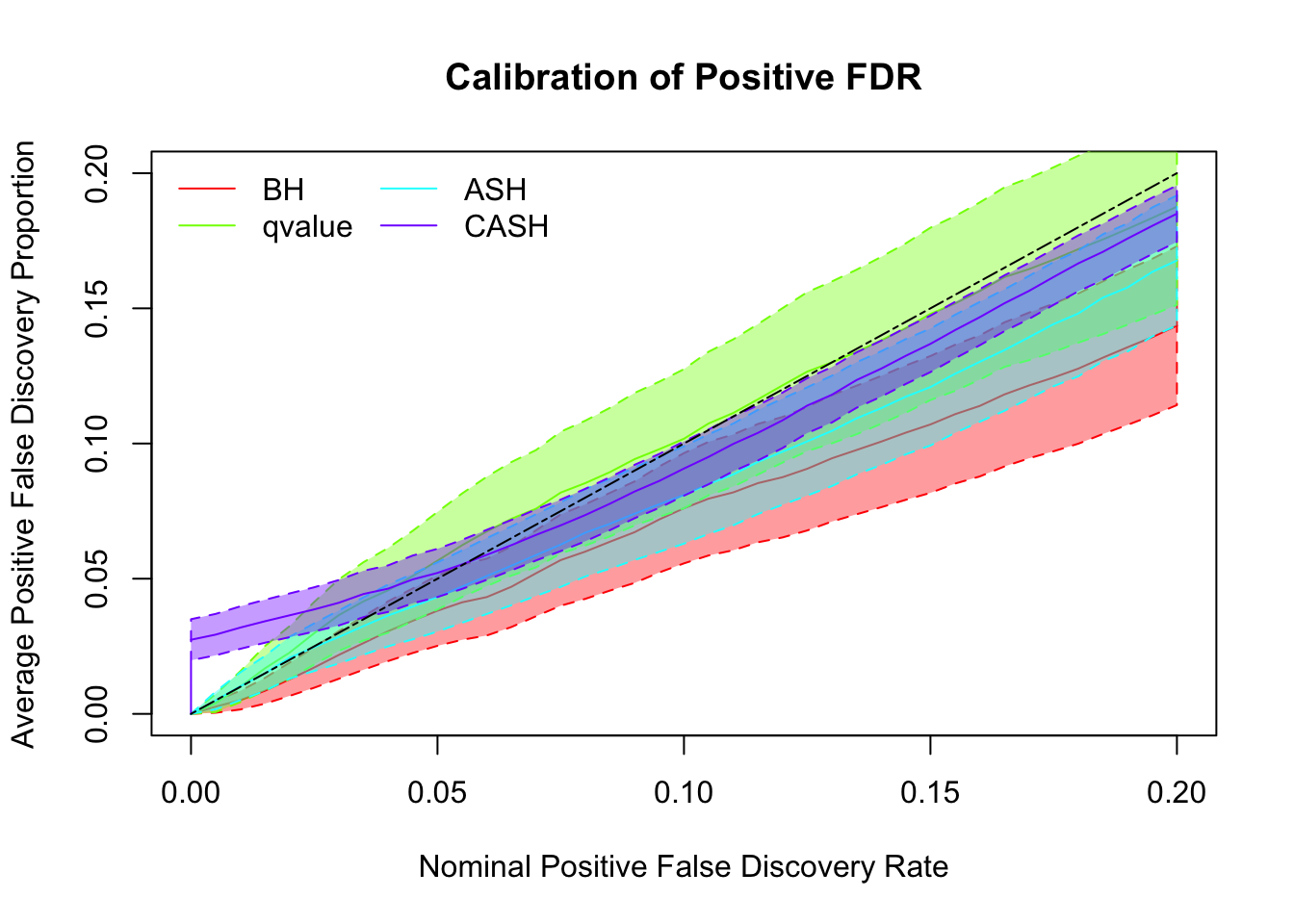

Simulation

cashSim(z.real, se.real,

nsim = 200, ngene = 1000,

g.pi = c(0.9, 0.1), g.sd = c(0, 2), relative_to_noise = TRUE)

Session information

sessionInfo()R version 3.4.2 (2017-09-28)

Platform: x86_64-apple-darwin15.6.0 (64-bit)

Running under: macOS High Sierra 10.13.1

Matrix products: default

BLAS: /Library/Frameworks/R.framework/Versions/3.4/Resources/lib/libRblas.0.dylib

LAPACK: /Library/Frameworks/R.framework/Versions/3.4/Resources/lib/libRlapack.dylib

locale:

[1] en_US.UTF-8/en_US.UTF-8/en_US.UTF-8/C/en_US.UTF-8/en_US.UTF-8

attached base packages:

[1] stats graphics grDevices utils datasets methods base

other attached packages:

[1] ashr_2.1-27 Rmosek_7.1.3 PolynomF_0.94 cvxr_0.0.0.9400

[5] REBayes_0.85 Matrix_1.2-11 SQUAREM_2017.10-1 EQL_1.0-0

[9] ttutils_1.0-1

loaded via a namespace (and not attached):

[1] Rcpp_0.12.13 knitr_1.17 magrittr_1.5

[4] MASS_7.3-47 pscl_1.5.2 doParallel_1.0.11

[7] lattice_0.20-35 foreach_1.4.3 stringr_1.2.0

[10] tools_3.4.2 parallel_3.4.2 grid_3.4.2

[13] git2r_0.19.0 iterators_1.0.8 htmltools_0.3.6

[16] yaml_2.1.14 rprojroot_1.2 digest_0.6.12

[19] gmp_0.5-13.1 codetools_0.2-15 evaluate_0.10.1

[22] rmarkdown_1.6 stringi_1.1.5 compiler_3.4.2

[25] backports_1.1.1 truncnorm_1.0-7 This R Markdown site was created with workflowr